Accrual of director fee since 2018 RM100000. Statutory audit fees expenditure.

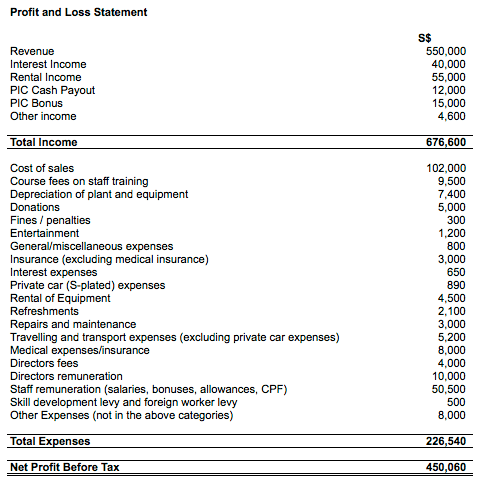

List Of Tax Deduction For Businesses Cheng Co Group

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income.

. KTP Company PLT AF1308 LLP0002159-LCA Can directors medical fee tax deductible in Sdn Bhd. Given 1 Kena Tax Sdn Bhd Balance Sheet show. Director Fee 应付董事费的注意 事项 The director is deemed to be able to obtain on demand the receipt of such amount in the basis period immediately following relevant period since 2015.

So first estimate the tax relief you can claim take salary amount that. Directors Remuneration and Tax Planning- Evidence from Malaysia. Accrual of director fee.

Tax Treatment Prior to Year of Assessment 2016 9 7. Directors Remuneration and Tax Planning- Evidence from Malaysia. In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967.

Director fees payable to an individual director whether said director is tax resident in Malta or not for directorship services rendered to a company which is managed and. Changes in year 2020. Public Ruling INLAND REVENUE BOARD OF MALAYSIA DIRECTORS LIABILITY No.

Director General of Inland Revenue Malaysia. KTP Company PLT AF1308. On 1 Jan 2018 the Board of Directors approved a director fee of RM100000 payable to the Director VICTOR CHOONG in respect of financial year ended 31 Dec 2017.

A notable update addresses the service tax treatment of directors fees or fees paid to office holdersincluding allowances and benefits-in-kind provided to directors. Tax Treatment Effective Year of Assessment 2016 4 6. The tax must be withheld and paid to Inland Revenue while details of the gross payment the tax withheld and.

Accrual of director fee since 2019 RM150000. TAX TREATMENT OF LEGAL AND. Is directors medical expense tax-deductible in Malaysia.

Tax Treatment in Respect of a Refund of an Advanced Payment 10 8. Resident companies are taxed at the rate of 24. Significance of Residence Status 41 Residence status is a question of fact and it is one of the main criteria that determines the tax treatment and tax.

TAX TREATMENT OF LEGAL AND PROFESSIONAL EXPENSES. Expenses incurred on secretarial and tax filing fees give a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA. By Thursday 12 January 2017.

The director fees received by directors who are employees of the corporation at the same time are considered compensation income. Outside Malaysia and a business trust. Also take director fee no additional tax relief to your company in form of employers KWSP portion.

Employment income subject to MTD includes salary wages commission overtime allowances director fees tips and bonuses arising out of exercising the employment. Thus subject to withholding tax on. The Royal Malaysian Customs Department RMCD released an updated service tax.

Generally if you pay a directors fee you are obliged to deduct tax at a flat 33. VICTOR CHOONG owns 51 of the ordinary shares in CO A SDN BHD and. Tax Treatment of Directors Fees and Bonuses from Employment 5 directors fees and the company was only liable to pay such fees on a date falling after the date the fees.

A fee or commercial purposes or modification of the content of the Public Ruling are prohibited. Changes made to service tax treatment of certain directors fees and allowances in Malaysia.

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Guide On Personal Tax Filing For Expatriate Employed By Labuan Company

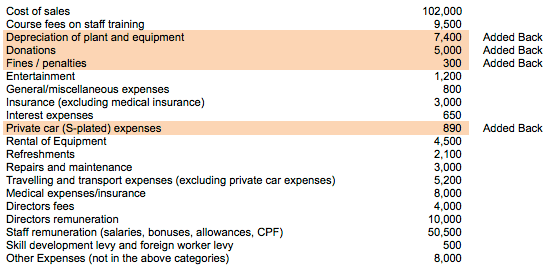

Tax Treatment On Entertainment Expenses Asq

Guide On Personal Tax Filing For Expatriate Employed By Labuan Company

Covid 19 The Enhanced Wage Subsidy Programme Bdo

Real Property Gains Tax Part 1 Acca Global

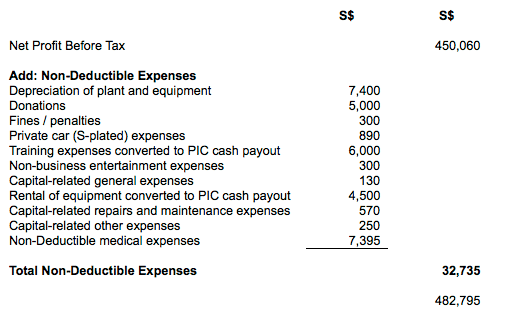

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Tax Treatment On Entertainment Expenses Asq

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

List Of Tax Deduction For Businesses Cheng Co Group

List Of Tax Deduction For Businesses Cheng Co Group

Recording Director S Expenses Correctly

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Covid 19 The Enhanced Wage Subsidy Programme Bdo

Tax And Secretarial Fee Tax Deduction Malaysia 2020 Dec 31 2020 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Malaysia Taxation Of Professional Services Kpmg United States